Page 40 - StudyTravel Magazine April 2025 Issue

P. 40

MARKET ANALYSIS

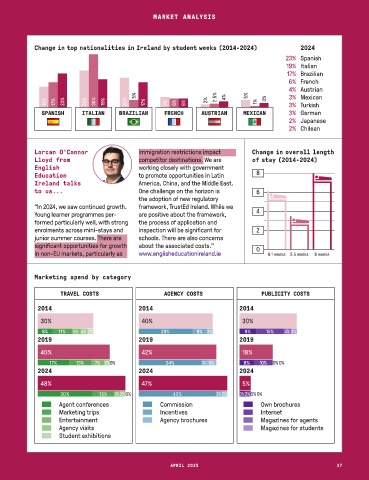

Change in top nationalities in Ireland by student weeks (2014-2024) 2024

23% Spanish

19% Italian

17% Brazilian

6% French

4% Austrian

5% 2.5% 4% 5% 3% Mexican

14% 17% 23% 25% 36% 19% 20% 17% 7% 6% 6% 2% 1% 3% 3% Turkish

SPANISH ITALIAN BRAZILIAN FRENCH AUSTRIAN MEXICAN 3% German

2% Japanese

2% Chilean

Lorcan O’Connor immigration restrictions impact Change in overall length

Lloyd from competitor destinations. We are of stay (2014-2024)

English working closely with government

Education to promote opportunities in Latin 8

Ireland talks America, China, and the Middle East.

to us... One challenge on the horizon is 6

the adoption of new regulatory

“In 2024, we saw continued growth. framework, TrustEd Ireland. While we 4

Young learner programmes per- are positive about the framework,

formed particularly well, with strong the process of application and

enrolments across mini-stays and inspection will be significant for 2

junior summer courses. There are schools. There are also concerns

significant opportunities for growth about the associated costs.” 0

in non-EU markets, particularly as www.englisheducationireland.ie 6.1 weeks 3.5 weeks 8 weeks

Marketing spend by category

TRAVEL COSTS AGENCY COSTS PUBLICITY COSTS

2014 2014 2014

30% 40% 30%

8% 11% 5% 4% 2% 29% 8% 3% 9% 15% 4% 2%

2019 2019 2019

40% 42% 18%

17% 13% 7% 3%0% 34% 3% 5% 8% 10% 0%0%

2024 2024 2024

48% 47% 5%

30% 13% 3%2%0% 42% 3% 2% 3%2%0%0%

Agent conferences Commission Own brochures

Marketing trips Incentives Internet

Entertainment Agency brochures Magazines for agents

Agency visits Magazines for students

Student exhibitions

APRIL 2025 37