Page 45 - StudyTravel Magazine December 2016 Issue

P. 45

language

MarKet analySiS nEW ZEaland

new Zealand’s

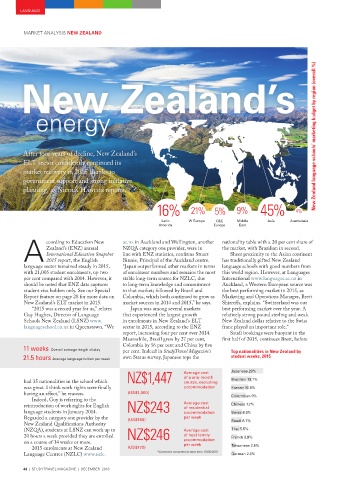

energy New zealand language schools’ marketing budget by region (overall %)

After four years of decline, New Zealand’s

ELT sector confi dently continued its

market recovery in 2015 thanks to

government support and strong initiative

planning, as Nicola Hancox reports.

16% 21% 5% 9% 45% 4%

latin W europe c&e Middle asia australasia

america europe east

ccording to Education New ac.nz in Auckland and Wellington, another nationality table with a 20 per cent share of

Zealand’s (ENZ) annual NZQA category one provider, were in the market, with Brazilian in second.

International Education Snapshot line with ENZ statistics, confi rms Stuart Sheer proximity to the Asian continent

a 2015 report, the English Binnie, Principal of the Auckland centre. has traditionally gifted New Zealand

language sector remained steady in 2015, “Japan outperformed other markets in terms language schools with good numbers from

with 21,005 student enrolments, up two of enrolment numbers and remains the most this world region. However, at Languages

per cent compared with 2014. However, it stable long-term source for NZLC, due International www.languages.ac.nz in

should be noted that ENZ data captures to long-term knowledge and commitment Auckland, a Western European source was

student visa holders only. See our Special to that market; followed by Brazil and the best performing market in 2015, as

Report feature on page 28 for more data on Colombia, which both continued to grow as Marketing and Operations Manager, Brett

New Zealand’s ELT market in 2015. market sources in 2014 and 2015,” he says. Shirreff s, explains. “Switzerland was our

“2015 was a record year for us,” relates Japan was among several markets best performing market over the year. A

Guy Hughes, Director of Language that experienced the largest growth relatively strong pound sterling and weak

Schools New Zealand (LSNZ) www. in enrolments in New Zealand’s ELT New Zealand dollar relative to the Swiss

languageschool.co.nz in Queenstown. “We sector in 2015, according to the ENZ franc played an important role.”

report, increasing four per cent over 2014. Saudi bookings were buoyant in the

Meanwhile, Brazil grew by 27 per cent, fi rst half of 2015, continues Brett, before

Colombia by 56 per cent and China by fi ve

11 weeks overall average length of stay

per cent. Indeed in StudyTravel Magazine’s Top nationalities in New zealand by

student weeks, 2015

21.5 hours average language tuition per week own Status survey, Japanese tops the

nZ$1,447 average cost Japanese 20%

of a one-month

had 35 nationalities in the school which course, excluding Brazilian 13.1%

was great. I think work rights were fi nally accommodation Korean 10.6%

(us$1,000)

having an eff ect,” he reasons. colombian 9%

Indeed, Guy is referring to the

reintroduction of work rights for English nZ$243 average cost chinese 7.7%

of residential

language students in January 2014. accommodation swiss 6.9%

Regarded a category one provider by the (us$168) per week saudi 6.7%

New Zealand Qualifi cations Authority

(NZQA), students at LSNZ can work up to nZ$246 average cost thai 5.5%

20 hours a week provided they are enrolled of host family French 3.9%

on a course of 14 weeks or more. accommodation taiwanese 2.6%

per week

2015 enrolments at New Zealand (us$170)

*Currencies converted to rates from 17/06/2015

Language Centres (NZLC) www.nzlc. german 2.5%

42 | Studytravel Magazine | deceMber 2016